Tax Deduction for Your Business

Question:

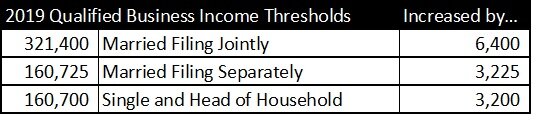

What are the 2019 Qualified Business Income (QBI) thresholds?

Answer:

As a business owner, you were probably introduced to the QBI deduction on your 2018 tax return. You may have been pleasantly surprised or sadly disappointed, depending on your total income and entity status. To plan properly for 2019, here are the inflation-adjusted QBI thresholds.

If your taxable income is below the thresholds, no worries. But once your taxable income goes over the thresholds, your QBI deduction may be limited or eliminated, depending if your business (1) is a specified service trade or business (SSTB), (2) paid W-2 wages, and/or (3) has qualified property held by the trade or business.

Example 1: If your business is an SSTB and if you hit one of the phaseouts below, no QBI deduction.

Example 2: If your business is not an SSTB and if you hit one of the phaseouts below, plus you paid no W-2 wages or had no qualifying property, no QBI deduction.